The historically underfunded European biotech sector is in the early stages of tapping into a new stream of capital thanks to the explosion of biomedical innovation in China, which has spawned a wave of investors looking for high quality science at attractive prices.

The influx is not only welcome in a region that historically has struggled to gain the attention of U.S. investors, but could open the door to the fastest growing healthcare market in the world.

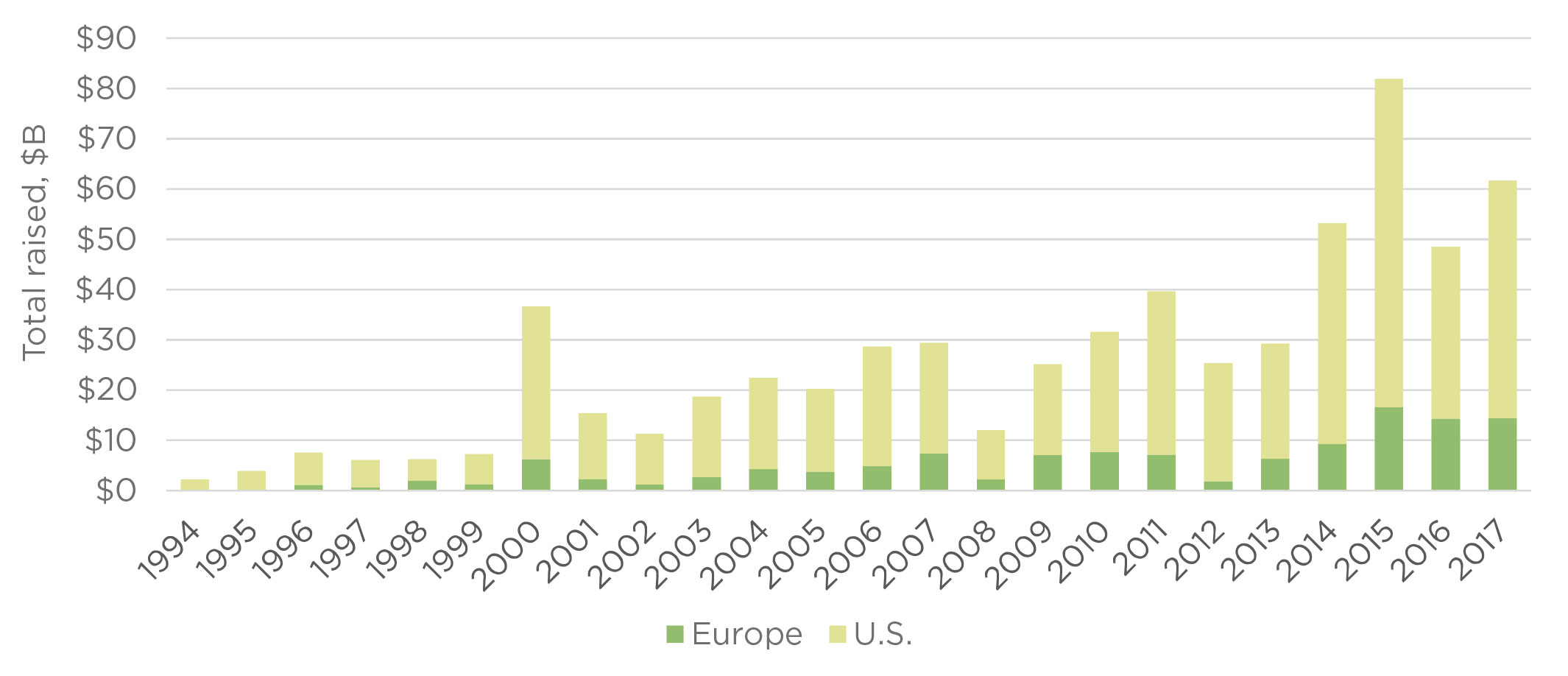

BioCentury’s annual review of the European financing environment finds that European biotechs continue to tread water in the competition for capital compared to their U.S. counterparts.

As the pie has grown over the last decade, Europe’s take has hovered at 20-30% of the total raised in the U.S. and Europe.

Last year, European biotechs raised $14.4 billion in public and private capital, less than one fourth of the $47.4 billion raised by U.S. companies (see “Competition for Capital”).

FIGURE: COMPETITION FOR CAPITAL

Chinese investors are seeing that as an opportunity. All nine Chinese investors contacted by BioCentury said they’re increasingly busy in Europe.

Chinese investors are seeing that as an opportunity. All nine Chinese investors contacted by BioCentury said they’re increasingly busy in Europe.

The quality of European science isn’t in doubt. But for Chinese investors, it often comes at a much lower price than they find either at home or in the U.S.

Ally Bridge’s Frank Yu noted each region represents a different valuation tier. “Chinese companies tend to have a hefty China premium, and the U.S. on the venture side is lower. And then the bottom is European assets.”

The arbitrage extends to public companies. “The European-U.S. arbitrage opportunity is a major driver of our investment gains,” said Yu. For example, the Hong Kong firm invested in CAR T company Cellectis S.A. prior to its NASDAQ listing in 2015. At the end of 2014, Cellectis’ market cap was $438.5 million on Euronext. Three months later the company raised $228.3 million in a follow-on on NASDAQ that gave it a postmoney valuation above $1.4 billion.

“Our European-U.S. arbitrage has been pretty much consistently 2x within several months,” Yu said.

Other European investments in Ally Bridge’s portfolio include T cell therapy play Adaptimmune Therapeutics plc, antibiotics company Nabriva Therapeutics plc, and Swiss specialty pharma Vifor Pharma Ltd.

About one-quarter of the European biotechs that listed on NASDAQ since 2012 had at least doubled in market cap by the end of 1Q18 compared with their postmoney valuation, and more than half saw at least a 25% increase (see “Europeans on NASDAQ”).

For some Chinese investors, the driving force in Europe is more access to innovation than the valuation arbitrage.

Ally Bridge also prioritizes that kind of ambition. “We focus on European life science assets with strong U.S. aspirations and capabilities,” Yu said.

Most of the investors said it is too early to identify clear trends in the types of assets Chinese investors are hunting. But some described interest in cell therapy and gene therapy companies, areas that are also of high interest in China domestically